Self-Employed Independent Pension Advice

An Independent Pension Specialist is available to you today to provide a comparison of structures, options and charges available for your situation.

Call (01) 5543 678

Or complete a review box today.

Get A Free Review

Just fill out the details below…

Self Employed

Depending on long term Investment objectives and ability to obtain tax relief the answer is a resounding YES.

You should be comfortable in your Retirement decisions and Long-term objectives. We will advise you on the most Tax efficient method of establishing your Pension Fund and getting the best value for money on Funds invested. We will compare the charges, fees and Fund Performances of all Pension Providers independently.

We will also examine any previous pensions you may have and advise you on consolidation of your Retirement plans. We will show you the way to maximize your Tax relief on Contributions and Tax-free cash payment from the Pension.

To avail of our assistance and guidance with a free Consultation within 24 hours, please call the number below or request a review.

Our Specialist Pension Advisor will assist you in compiling a risk strategy that suits your age profile and Financial plan. The objective for the Sole Trader is to maximize Tax relief on your income while investing in a well-balanced Financial plan for Retirement.

There are a range of Pension plans and strategies suitable for the Self-Employed. Please call below to avail of best advice on the range of Tax efficient options available to you or request a review with our Experienced Pension Advisors.

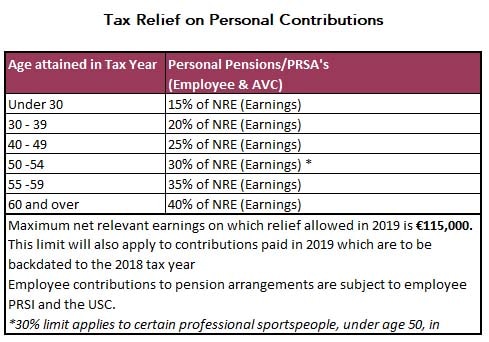

As a Self-Employed Sole Trader, or a Company Director, there are highly Tax efficient options available. In simple terms, any trading profit which you make after the deduction of genuine cost and expenses is classed by Revenue as taxable income. Tax Relief is available on any personal pension payment made up to the maximum allowed on the scale below or an overall €115,000 Net Relevant Earnings.

In simple terms, any Self-Employed pension payment made against income earned at the high rate of tax can receive full Tax relief at 40%. We can assist you with calculating your maximum pension payable and your optimum tax relief available. To receive assistance with your Self-Employed pension relief calculation, please call below or request your review before you finalise your personal tax return.

Very little, except that P.R.S.A.’s may be more cost efficient or portable between employments / contracts. An employer who doesn’t have an official occupational scheme cannot add money to your Personal Pension but they can contribute to your PRSA.

It can be the case and Brokers and Pension Providers very greatly in the charges and fees applied to Personal Plans. We will run a comparison of all the regulated Pension Providers in the market for any new plan or top up Pension payment. We will consider any existing plan you may have and the schedule of charges and fees you are paying at present. We will compare them to current offering on the market and calculate the maximum amount that you can contribute at the lowest and most competitive management charges and fees. Call the number below or request a review and we will be in touch within 24 hours.

Impartial advice and a thorough comparison is the hallmark of our specialist Pension service. We will always complete a comprehensive fact find on your individual situation. We will be seeking the most affordable and Tax efficient mechanism available to you. Our search takes in all of the Pension Providers in the market and examines their detailed costs and fees (including hidden charges). We assess the independently reported performance of their Investment funds under each risk category over at least the last 5 years.

It is essential that you get value for money and that the maximum amount of your contributions is invested in your retirement plan. To get the assistance of our experienced Pension planner and evaluation process, please call the number below or request a review.

Of course, Tax relief can be obtained on the Pension payments which have the effect of reducing your Income tax or Corporation tax bill. We specialise in optimizing the Pension Contributions while complying with all Revenue and Regulatory provisions. Your objective is to minimize your tax payment while increasing your Pension Contributions and Entitlements. We will assist you in maximizing your tax-free cash at Retirement.

To achieve the optimum pension provision in the most tax efficient fashion, please call the number below or request a review. We will be on your case within 24 hours.

What Our Clients Say

”Our Customers Have Rated Us “Great”

Extremely great service

As a self-employed small business person, I had no idea about pensions. Pension Planning/ New Alliance assigned an experienced advisor to me. I restricted my pension arrangements and reviewed old plans. My employment and pension plans are now perfectly aligned with my business in a simple tax efficient strategy.

S.K., Galway