Terms of Business

Terms of Business – Version 1.5 Effective from September 2020

Servatus Ltd.

These Terms of Business set out the general terms under which our firm will provide business services to you and the respective duties and responsibilities of both the firm and you in relation to such services. Please ensure that you read these terms thoroughly and if you have any queries we will be happy to clarify them. If any material changes are made to these terms we will notify you.

Authorization with the Central Bank of Ireland

Servatus Ltd. (C52044) is regulated by the Central Bank of Ireland as an insurance intermediary registered under the European Union (Insurance Distribution) Regulations 2018 and as an Investment Intermediary authorised under the Investment Intermediaries Act, 1995. Copies of our regulatory authorizations are available on request. The Central Bank of Ireland holds registers of regulated firms. You may contact the Central Bank of Ireland on 1890 777 777 or alternatively visit their website at www.centralbank.ie to verify our credentials.

Codes of Conduct

Servatus Ltd. is subject to the Consumer Protection Code, Minimum Competency Code and Fitness & Probity Standards which offer protection to consumers. These Codes can be found on the Central Bank’s website www.centralbank.ie

Our Services

Our principal business is to provide advice and arrange transactions on behalf of clients in relation to life & pensions and Investment products. A full list of insurers, product producers and lending agencies with which we deal is available on request. Servatus Ltd. acts as an Independent Broker which means that:

- the principal regulated activities of the firm are provided on the basis of a fair and personal analysis of the market; and

- you have the option to pay in full for our services by means of a fee.

Fair And Personal Analysis

The concept of fair and personal analysis describes the extent of the choice of products and providers offered by an intermediary within a particular category of life assurance, general insurance, mortgages, and / or a specialist area. The number of contracts and providers considered must be sufficiently large to enable an intermediary to recommend a product that would be adequate to meet a client’s needs.

The number of providers that constitutes ‘sufficiently large’ will vary depending on the number of providers operating in the market for a particular product or service and their relative importance in and share of that market. The extent of fair analysis must be such that could be reasonably expected of a professional conducting business, taking into account the accessibility of information and product placement to intermediaries and the cost of the search.

In order to ensure that the number of contracts and providers is sufficiently large to constitute a fair and personal analysis of the market, we will consider the following criteria:

- the needs of the customer,

- the size of the customer order,

- the number of providers in the market that deal with brokers,

- the market share of each of those providers,

- the number of relevant products available from each provider,

- the availability of information about the products,

- the quality of the product and service provided by the provider,

- cost, and

- any other relevant consideration.

Investment Intermediary Services

We do not discriminate between higher or lower value clients and we do not have any minimum value requirements to engage our advisory services. While preferring to provide investment services on a fee only basis we recognize that this does not suit all client’s needs and therefore provide an option of both Fee Based Advice and Investment Structures whereby we are remunerated by Commission paid by Product Providers.

To Clarify – When we provide Investment Intermediary Services on the basis of independent advice. This means that the firm does not accept any third party payments (i.e. Commissions) from Providers.

A schedule of our hourly fees is outlined below and our investment services is described in our Investment Intermediary Services document which includes a fee agreement. However, when we are engaged through Investment Intermediary Services we may use Insurance Based Investments Products. In this instance we will return to customers or offset against fees to be paid by the customer, any fees, commissions or non- monetary benefits paid or provided by any third party or person acting on behalf of a third party in relation to the services provided to that customer as soon

as reasonably possible after receipt.

Or, We are remunerated by completely through a commission arrangement for the advice we provide on our insurance based investment products.

Life Assurance products, Life Wrapped Investment, Deposits & Retirement Products

Servatus Ltd. provides life assurance, income protection, investment and pensions on a fair and personal analysis basis i.e. providing services on the basis of a sufficiently large number of contracts and product producers available on the market to enable us to make a recommendation, in accordance with professional criteria, regarding which contract would be adequate to meet your needs.

We will provide assistance to you in relation to any queries you may have with regard to any policy, or in the event of a claim during the life of a policy and we will explain to you the various restrictions, conditions and exclusions attached to your policy. However, it is your responsibility to read the policy documents, literature and brochures to ensure that you understand the nature of the policy cover; particularly in relation to PHI and serious illness policies.

Specifically on the subject of permanent health insurance policies we will explain to you; a) the meaning of disability as defined in the policy; b) the benefits available under the policy; c) the general exclusions that apply to the policy; and d) the reductions applied to the benefit where there are disability payments from other sources.

For a serious illness policy, we will explain clearly to you the restrictions, conditions and general exclusions that attach to that policy

Statement of Charges

We may earn our remuneration on the basis of fees, commission and any other type of remuneration, including an economic benefit of any kind offered or given with the insurance contract.

You may choose to pay in full for our services by means of a fee. Where we receive recurring commission, this forms part of the remuneration for initial advice provided. We reserve the right to charge additional fees if the number of hours relating to on-going advice/assistance exceeds the hours anticipated and quoted at the outset.

In certain circumstances, it will be necessary to charge a fee for services provided. These are listed below. In other circumstances where fees are chargeable or where you choose to pay in full for our service by fee, we will notify you in writing in advance and agree the scale of fees to be charged if

different from fees outlined below. Where it is not possible to provide the exact amount, we will provide you the method of calculation of the fee.

If we receive commission from a product provider, this may be offset against the fee which we will charge you. Where the commission is greater than the fee due, the commission may become the amount payable to the firm unless an arrangement to the contrary is made.

A summary of the details of all arrangements for any fee, commission other reward or remuneration paid or provided to us which have agreed with product providers is available on our websites – www.pensionplanning.ie www.servatus.ie

Our Ongoing Investment Services

For investments/savings and pension investments, we charge based on a percentage of the amount invested, which you can choose how you pay.

Typically:

Initial Fee: 3% of the amount you invest as a lump sum, so if you invest €10,000 we will charge you €300 for the advice and arrangement. If you invest €100,000, the charge will be €3,000 or if you invest €300,000 it will be €9,000 and so on. If you invest as a regular premium (for example, €100 per month) we would take 5% or €5 of the regular contribution ongoing.

On-going fee: If you choose to select this service, this is 1% of the value of your investment, so if you had an investment valued at €10,000 we would charge you €100 for the years’ service.

Please see our separate service proposition document for further details.

Life and Pensions

You may elect to deal with us on an upfront advice only fee basis.

- Principles / Directors €350 p.h.

- Senior Advisers €300 p.h.

- Associates €200 p.h.

- Support staff €80 p.h.

Additional fees may be payable for complex cases or to reflect value, specialist skills or urgency, or the employment services of outside expertise. We will notify you in advance and agree the scale of fees to be charged.

Investment Fees

- Principles / Directors €350 p.h.

- Senior Advisers €300 p.h.

- Associates €200 p.h.

- Support staff €80 p.h.

Additional fees may be payable for complex cases or to reflect value, specialist skills or urgency, or the employment services of outside expertise. We will notify you in advance and agree the scale of fees to be charged.

Personal Retirement Savings Accounts (PRSAs) – Fees

Where advice is requested for PRSAs, the following hourly fees will apply:

- Advisor fees: €250 p.h.

- Support staff: €80 p.h.

Additional fees may be payable for complex cases or to reflect value, specialist skills or urgency, or the employment services of outside expertise. We will notify you in advance and agree the scale of fees to be charged.

If we receive commission from a product provider, this will be offset against the fee which we will charge you. Where the commission is greater than the fee due, the commission will become the amount payable to the intermediary unless an arrangement to the contrary is made.

Insurance Based Investment Products

If clients choose to pay by means of a fee or by means of our Ongoing Investment Service, we will return to customers or offset against fees to be paid by the customer, any fees, commissions or non-monetary benefits paid or provided by any third party or person acting on behalf of a third party in relation to the services provided to that customer as soon as reasonably possible after receipt.

Disclosure of Information

Any failure to disclose material information may invalidate your claim and render your policy void.

Regular Reviews

It is in your best interests that you review, on a regular basis, the products which we have arranged for you. As your circumstances change, your needs will change. You must advise us of those changes and request a review of the relevant policy so that we can ensure that you are provided with up to date advice and products best suited to your needs. Failure to contact us in relation to changes in your circumstances or failure to request a review may result in you having insufficient insurance cover and/or inappropriate investments. If you choose our Ongoing Investment Services then regular reviews initiated by us will include a review of all financial products.

Conflicts of Interest

It is the policy of our firm to avoid conflicts of interest in providing services to you. However, where an unavoidable conflict of interest arises we will advise you of this in writing before providing you with any service. A full copy of our conflicts of interest policy is available on request.

In some cases, we may be a party to a profit-share arrangement with product producers where we provide extra services for the provider. Any business arranged with these providers on your behalf is placed with them as they are at the time of placement the most suitable to meet your requirements taking all relevant information, demands and needs into account. There are currently no agreements to this effect in place.

Default on payments by clients

We will exercise our legal rights to receive payments due to us from clients (fees and insurance premiums) for services provided. In particular, without limitation to the generality of the foregoing, the firm will seek reimbursement for all payments made to insurers on behalf of clients where the firm has acted in good faith in renewing a policy of insurance for the client.

Product producers may withdraw benefits or cover in the event of default on payments due under policies of insurance or other products arranged for you. We would refer you to policy documents or product terms for the details of such provisions.

Complaints

Whilst we are happy to receive verbal complaints, it would be preferable that any complaints are made in writing. We will acknowledge your complaint in writing within 5 business days and we will fully investigate it. We shall investigate the complaint as swiftly as possible, and the complainant will receive an update on the complaint at intervals of not greater than 20 business days starting from the date on which the complaint is made. On completion of our investigation, we will provide you with a written report of the outcome. In the event that you are still dissatisfied with our handling of or response to your complaint, you are entitled to refer the matter to the Financial Services and Pensions Ombudsman (FSPO). A full copy of our complaints procedure is available on request.

Protection

We are subject to the requirements of the General Data Protection Regulation 2018 and the Irish Data Protection Act 2018. Servatus Ltd. is committed to protecting and respecting your privacy. We wish to be transparent on how we process your data and show you that we are accountable with the GDPR in relation to not only processing your data but ensuring you understand your rights as a client.

The data will be processed only in ways compatible with the purposes for which it was given and as outlined in our Data Privacy Notice, this will be given to all our clients at the time of data collection.

New consumer responsibilities arising out of the Consumer Insurance Contracts Act 2019 which was implemented to protect consumers.

New Business & Renewal

You may cancel a contract of insurance, by giving notice in writing to the insurer, within 14 working days after the date you were informed that the contract is concluded. This does not affect the notice periods already provided under European Union (Insurance and Reinsurance) Regulations 2015 ( S.I. No. 485 of 2015 ) or the European Communities (Distance Marketing of Consumer Financial Services) Regulations 2004 ( S.I. No. 853 of 2004 ) which is 30 days in respect of life policies, irrespective of whether the sale took place on a non-face to face basis, and 14 days in respect of general policies only on sales that took place on a non-face to face basis (distance sales).

The giving of notice of cancellation by you will have the effect of releasing you from any further obligation arising from the contract of insurance. The insurer cannot impose any costs on you other than the cost of the premium for the period of cover. This right to cancel does not apply where, in respect of life assurance the contract is for a duration of six months or less, or in respect of general insurance, the duration of the contract is less than one month.

You are under a duty to pay your premium within a reasonable time, or otherwise in accordance with the terms of the contract of insurance.

A court of competent jurisdiction can reduce the pay-out to you if you are in breach of your duties under the Act, in proportion to the breach involved.

Post-Contract Stage and Claims

An insurer may refuse a claim made by you under a contract of insurance where there is a change in the risk insured, including as described in an “alteration of risk” clause, and the circumstances have so changed that it has effectively changed the risk to one which the insurer has not agreed

to cover.

Any clause in a contract of insurance that refers to a “material change” will be interpreted as being a change that takes the risk outside what was in the reasonable contemplation of the contracting parties when the contract was concluded.

You must cooperate with the insurer in an investigation of insured events including responding to reasonable requests for information in an honest and reasonably careful manner and must notify the insurer of the occurrence of an insured event in a reasonable time.

You must notify the insurer of a claim within a reasonable time, or otherwise in accordance with the terms of the contract of insurance.

If you become aware after a claim is made of information that would either support or prejudice the claim, you are under a duty to disclose it. (The insurer is under the same duty).

If you make a false or misleading claim in any material respect (and know it to be false or misleading or consciously disregards whether it is) the insurer is entitled to refuse to pay and to terminate the contract.

Where an insurer becomes aware that a consumer has made a fraudulent claim, they may notify the consumer advising that they are voiding the contract of insurance, and it will be treated as being terminated from the date of the submission of the fraudulent claim. The insurer may refuse all liability in respect of any claim made after the date of the fraudulent act, and the insurer is under no obligation to return any of the premiums paid under the contract.

Anti-Money Laundering Measures

How we handle the information you give us and ensure our compliance with anti-money laundering regulations. We are required by the anti-money laundering regulations to verify the identity of our clients, to obtain information as to the purpose and nature of the business which we conduct on their behalf, and to ensure that the information we hold is up-to-date. For this purpose we may use electronic identity verification systems and we may conduct these checks from time to time throughout our relationship and not just at the beginning.

We will ensure that this Privacy Notice is easily accessible. Please refer to our website http://servatus.ie/privacy-statement-2/, if this medium is not suitable we will ensure you can easily receive a copy by hard copy.

Please contact at [email protected] if you have any concerns about your personal data.

Compensation Scheme

We are members of the Investor Compensation Scheme operated by the Investor Compensation Company Ltd. See below for details.

The Investor Compensation Act, 1998 provides for the establishment of a compensation scheme and the payment, in certain circumstances, of compensation to certain clients (known as eligible investors) of authorised investment firms, as defined in that Act.

The Investor Compensation Company Ltd. (ICCL) was established under the 1998 Act to operate such a compensation scheme and our firm is a member of this scheme.

Compensation may be payable where money or investment instruments owed or belonging to clients and held, administered or managed by the firm cannot be returned to those clients for the time being and where there is no reasonably foreseeable opportunity of the firm being able to do so.

A right to compensation will arise only:

- If the client is an eligible investor as defined in the Act; and

- If it transpires that the firm is not in a position to return client money or investment instruments owned or belonging to the clients of the firm; and

- To the extent that the client’s loss is recognised for the purposes of the Act.

Where an entitlement to compensation is established, the compensation payable will be the lesser of:

- 90% of the amount of the client’s loss which is recognised for the purposes of the Investor Compensation Act, 1998; or

- Compensation of up to €20,000.

For further information, contact the Investor Compensation Company Ltd. at (01) 224 4955

Brokers Ireland Compensation Fund

We are also members of the Brokers Ireland Compensation Fund. Subject to the rules of the scheme the liabilities of its members firms up to a maximum of €100,000 per client (or €250,000 in aggregate) may be discharged by the fund on its behalf if the member firm is unable to do so, where the above detailed Investor Compensation Scheme has failed to adequately compensate any client of the member. Further details are available on request.

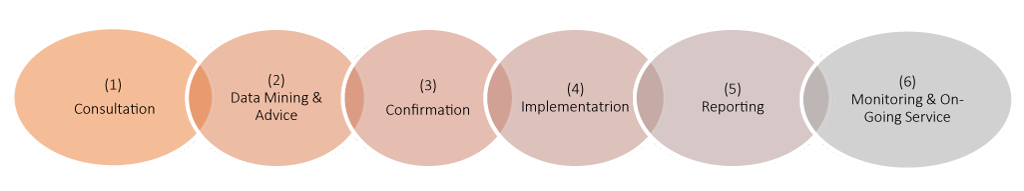

Our Advice Process

In order to help ensure reliable, repeatable results for our customers and to help ensure business is performed in a controlled, quality manner, we run a six stage independent advice process as follows:

1. Consultation

The initial “getting to know you” phase where we make an assessment of the financial products you need.

This is the stage where we get to know you as a customer, through a Fact Finding Process, you supply us with relevant information to allow us to advise you on the most suitable course of action. You need to be prepared to fully and openly discuss the areas which are included, but not limited to, this part of the process:

i. Your goals, concerns and the financial considerations you feel are important;

ii. Your existing financial arrangements and full personal circumstances;

iii. Your financial knowledge and your attitude and tolerance towards risk and loss, both of which are critically important:

o With regards to investments, this obviously includes your attitude to the varying nature of investment values- how much risk do you want to take and how much loss in the value of investments would you be happy to accept as part of your overall objective

o This information helps us to understand your financial objectives and focuses our analyses.

2. Data Mining & Advice

Continuation of the Consultation process, here we focus on obtaining further detailed information about you and your financial contracts, performing our internal research and then reporting to meet your needs.

This process covers the:

i. Analysis of any existing financial products for suitability against your requirements.

ii. Preparation of our recommendations to you;

iii. Drafting our report to explain and discuss our recommendations in detail.

3. Confirmation

Here we confirm what our advice is.

i. This is usually upon issuance of our report, with similar actions for all advice areas. During this stage you need to:

– Ensure nothing has changed since our prior meeting;

– Review our advice and recommendations;

– Review any pertinent additional documentation supplied;

– Confirm that you have received our advice.

4. Agree & Implement

i. You decide if you want to act on any or all of our recommendations.

ii. We implement the agreed actions.

5. Report

Here we confirm our advice to third parties.

i. You will be provided with a comprehensive report outlining:

o The reasons why respective recommendations were made;

o Reminders of pertinent points from discussions held and the conclusions reached;

o Any other items which you need to bear in mind with regards to the actions taken.

ii. We will confirm to your

6. Cancellation Right

The right to change your mind.

For Life Assurance contracts Cooling Off Periods will apply.